What is Cibil score?

Credit scores are given to each individual with a bank account to determine the eligibility to submit and get approved for loans and other credit facilities. Cibil is an Indian credit bureau that gives credit scores to people. This credit score reflects your credit history which includes all credit facilities used or misused such as loans and credit cards. Credit scores are important because they determine how much debt you can take and how much interest can be collected by the bank or NBFC to you. Poor credit scores will produce high interest rates and lower loan amounts.

How can you calculate your cibil score?

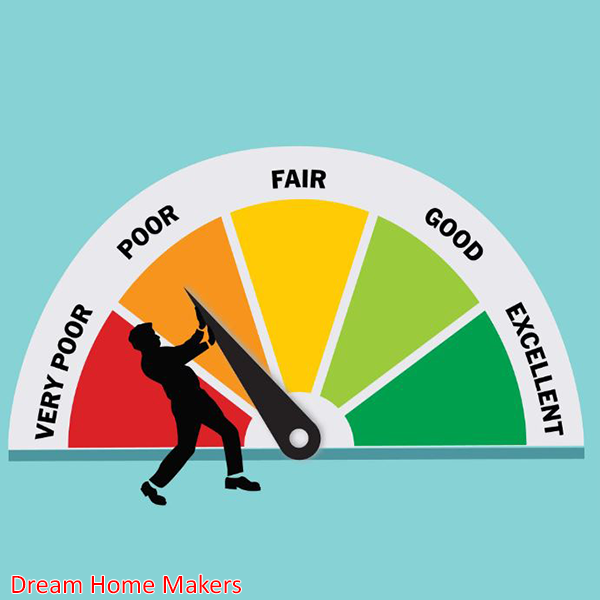

Cibil scores are usually placed in a range of 300-900. The right calculation is a mixture of various aspects of your credit history and the risks you have taken in your financial investment. Some aspects that affect your credit score calculation are:-

• Payment made to credit

• Credit card payments

• Loan application

• Existing debt

• Unpaid debt

• History of payment and its frequency

The right calculation method is very complicated. The aspects mentioned above are considered with more facts, and the weight varies from one factor to another. Credit scores are calculated every year with credit reports issued and available for review.

How to increase the Cibil score immediately?

Having a good credit score affecting the ability to get loans with the best interest rates. The total credit value drops with a decrease in one's credit score. If you wonder how to increase the cibil score, look at this instructions to have a good credit score.

Make a Credit Card Payment on Time

The most important and very easy way to increase your credit score is to make payments on time. The delayed payment is the worst blow for credit card scores. Cibil considers delayed payments to be very risky and as a result, you might lose a lot of scores. If you cannot fulfill full payment, only basic rights can be paid to avoid marked as a risk. However, it is not recommended to continue this practice because it will be taken by Cibil.

Don't use your credit card

Having a credit card does not mean you always have luxury to spend money to the maximum limit. Avoid maximizing your card so as not to be calculated as excess and debt debt. It is recommended to leave a 30% gap between your credit and the maximum credit limit. Maxing out cards on several occasions must be avoided at all costs because it signals a bad financial decision.

Don't take too many credit cards

Always recommended to avoid taking too many credit cards. When you combine the maximum limit of several credit cards, it might indicate that you have the advantages. Having a credit card in many banks must also be avoided because it reflects your credit score badly. Has a number of cards under one bank. Rejection of credit card applications by banks can also negatively affect your credit score.

Monitor your credit report

Sometimes your credit report may have differences and problems, display your credit score incorrectly. You should always try to review your credit report to see if there are errors or calculation errors that might unfairly reflect your credit score. Having an error in a fairly common credit report is why Cibil allows you to review and check your report once a year.

Avoid Having Zero Credit

Not taking credit for fear of having a bad score does not help. You must have some loans that are paid to ensure your reliability to your lender. People who do not take credit consciously may eventually be labeled as a high-risk borrower due to lack of records that prove their timely payments.

Increase the consciously credit card limit

By increasing the credit card limit, you can avoid using the limits of your credit card too much. Going beyond your credit card limit is often read as a risk in calculating its credit rating. Therefore, you must try to increase the credit limit to avoid entering situations that could be considered risks.

Try not to leave space for risks

Credit scores do not only depend on the final payment in a timely manner on the closing date of the mandate. Any delayed reimbursement, even in 1 to 2 months, can lead to risk detection and reduce your score. Do not try to find gaps by paying less in the reimbursements of credit card contributions. Pay at least basic contributions to avoid having greater problems.

Limit to having many credit card lines

Many people prefer to use credit lines to increase their credit limits. However, this practice can have negative effects and harmful consequences on its credit scores. The creation of new credit card lines leads to difficult requests. Too much of these difficult requests over time can affect your chances of guaranteeing loans. The rejection of the loan call will also seriously affect your Cibilian scores.

Include information on old loans

Although former loans can mean financial risks, they will help you improve your credit score. Since the credit rating is calculated and fixed by the weight of your credit repayment capacities, old loans can be the best opportunity to increase your score. If you can show old loans and reimbursement in a timely manner, your capacity and punctuality will be proven.

Adopt several strategies and patiently wait for the results

It is not possible to increase and improve your Cibilian score overnight. Cibil score is easily affected by errors and risks on your part. However, rectifying the credit rating can take a long time. You may need to adopt several strategies and slowly develop your score over time.

Related posts:

Dianthus flowers, commonly known as carnations or pinks, are popular garden flowers appreciated for their colorful blooms and pleasant fragrance. Here are some guidelines on how to grow and care for Dianthus flowers:

New Year's Decorations, Ideas, and Recipes. Make your New Year's Eve party the talk of the town with cool recipes, trendy decorations, and some fun ideas. Decorate your home beautifully with Balloon decorations this New Year 2024. Make your room,...

How to grow and care for Dianthus flowers?

How to grow and care for Dianthus flowers?

New Year party decoration ideas for home

New Year party decoration ideas for home

Best Eco-Friendly Home Designs In India

Best Eco-Friendly Home Designs In India

Real Estate Investing

Real Estate Investing

7 Open House Food Ideas

7 Open House Food Ideas